Dimerco leverages Asia logistics expertise to navigate complex 2026 freight market

Dimerco’s 2026 outlook shows AI growth and China+ shifts driving tight air capacity, uneven ocean supply and rising compliance challenges for global shippers.

In 2026, the overall market outlook will be cautiously optimistic,” said Catherine Chien, Chairwoman of Dimerco Express Group. “Ocean freight will not be driven by a sudden surge in demand, but rather by capacity imbalances and regional differences. At the same time, demand for high-tech, AI-related, and e-commerce shipments continues to drive growth in air freight from the Asia-Pacific region to North America and Europe. Our role is to integrate our ocean and air freight, contract logistics, and brokage and compliance resources to help customers build supply chains that are both secure and resilient.

Freight market outlook: capacity is back, but complexity is higher

-------------------------------------------------------------------------------------

On the ocean side, new vessel deliveries and relatively stable bunker prices are being offset by structural bottlenecks. Major European hubs continue to face congestion, while Red Sea and Suez diversions still disrupt rotations and tie up ships and equipment. Regional tariff and carbon schemes are fragmenting cost structures. As a result, some Asia–Europe services have seen rates rebound from unsustainably low levels, even as several Transpacific lanes face softer demand and continued rate pressure. Global schedule reliability has recovered to around 65 percent but remains below pre-pandemic levels; for many shippers, booking at least three weeks in advance on key trades has become standard risk management. Overall, the 2026 ocean freight market is not defined by a demand boom, but by capacity often being in the wrong places and by strong regional differences.

Airfreight tells a different story. Demand is driven by AI servers and semiconductor equipment, communications and electronic components, and resilient cross-border e-commerce. “Taiwan+, China+” manufacturing strategies are shifting production toward Southeast Asia and India, driving strong growth in air volumes from these origins - as well as from Taiwan - into North America and Europe. Following changes to US de minimis rules, some direct China–US e-commerce flows have decreased, but more cargo is now routed via alternative hubs and forward-stocking models, making trade lanes more diversified. Shippers that can flex between multiple lanes, multiple modes and multiple origin countries will be better positioned than those relying on a single country or mode.

China+, Taiwan+ and tariffs: four logistics pain points

---------------------------------------------------------------------

Manufacturers extending production from China into Southeast Asia, India or Mexico typically face four major challenges:

⦿ Inadequate capacity at critical times, as port congestion, diversions and blank sailings reduce effective ocean supply even when the global fleet is large.

⦿ Difficulty choosing a second warehouse or hub outside China that truly optimizes total landed cost—combining transport, duties, inventory and lead time with available government incentive schemes at each location.

⦿ Limited knowledge of local regulations, customs requirements and trade-compliance rules.

⦿ Lack of practical experience managing complex factory relocations involving used machinery and oversized equipment.

Dimerco’s solutions: from capacity to compliance

-----------------------------------------------------------------

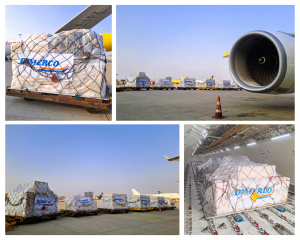

To close capacity and lead-time gaps as more freight shifts from Southeast Asia to North America and Europe, Dimerco combines multi-modal options with consolidation through selected Asia gateways. This approach helps secure uplift for high-value cargo when local air capacity is tight, while preserving flexibility on routing and transit time.

For manufacturers searching for a “second hub” outside China, Dimerco applies a structured assessment tool to compare locations across Southeast Asia. The analysis covers service levels, duties and taxes, regulatory and investment environment (including incentive schemes), transport infrastructure and labor. Using this framework, Dimerco has helped global customers select and launch warehouse hubs in markets such as Singapore, Malaysia, Thailand and Vietnam, enabling more flexible inventory deployment between China and secondary locations and giving shippers more routing options as conditions change.

Dimerco also supports complex factory and line relocations. In one case, a data-center and IT equipment manufacturer planned to move a production site from Singapore to Malaysia in 48 weeks; Dimerco completed the relocation in just 36 weeks by coordinating government liaison, customs-compliance advisory for used machinery and heavy-lift transport using a combination of low-bed and open trucks.

With more than 45 years of operational experience in Southeast Asia, Dimerco helps foreign manufacturers navigate customs and regulatory environments through FTZ and bonded warehouses across Mainland China, Hong Kong, Taiwan, India, Southeast Asia, Mexico and the US. Dimerco’s Expand to India Advisory Service allows customers to implement phased “Test – Trade – Manufacture” models, utilize FTZ and bonded policies to optimize duties and inventory placement, and reduce compliance risks in multi-country, multi-node supply chains.

Building for AI-driven growth in 2026

-------------------------------------------------

Dimerco’s differentiation is centered on three areas: deep Asia presence, with around 130 owned offices across the region; a focus on high-value, time-critical freight in sectors such as semiconductors, electronics and aerospace; and consistent systems and quality, enabled by a secure, cloud-based global operating platform that connects air, ocean, customs, warehousing and distribution services.

“For our customers, 2026 is not about whether they will grow, but about how to grow safely under new tariff, compliance and capacity constraints,” added Catherine Chien. “By combining flexible multi-modal options—such as switching from sea to air for urgent shipments, or from air to sea for cost-sensitive cargo with controlled lead times—with strategic charter flight services, deep Asia expertise, integrated warehousing solutions and strong compliance advisory, Dimerco is ready to help customers turn AI, Taiwan+, China+ from buzzwords into real, executable opportunities.”

About Dimerco

--------------------

Dimerco Express Group integrates air and ocean freight, trade compliance, and contract logistics services to make global supply chains more effective and efficient. The majority of the company’s global logistics projects connect Asia’s logistics and manufacturing hubs with each other, and with North America and Europe. Started as an air freight forwarder in Taiwan in 1971, Dimerco now serves customers from 150+ Dimerco offices, 80 contract logistics operations, and 200+ strategic partner agents throughout China, India, Asia Pacific, North America, and Europe.

Learn more: https://dimerco.com/

For media enquiries, contact:

Gitte Willemsens

Pesti Group

gitte.w@pesti.io

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Dimerco has helped global customers select and launch warehouse hubs in markets such as Singapore, Malaysia, Thailand and Vietnam…

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.